-

Gallery of Images:

-

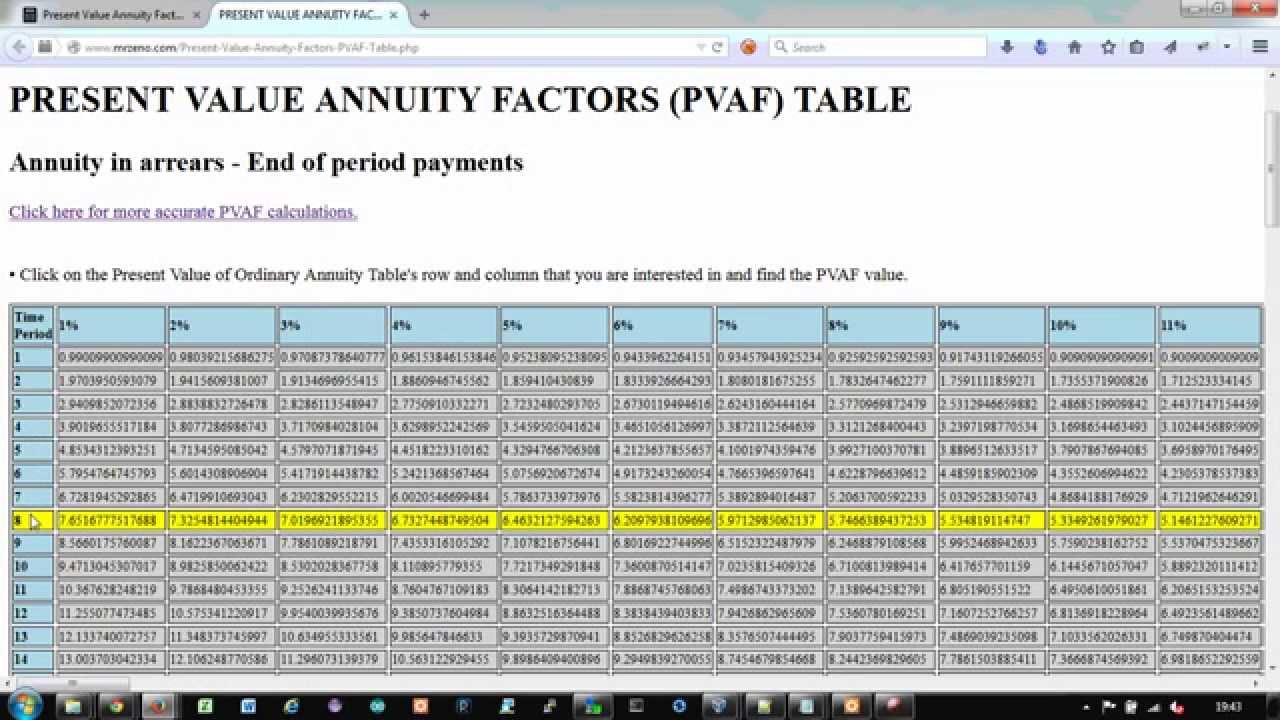

Present value of ordinary annuity table 60 periods awesome home 26 cfr 20 2031 7 valuation of annuities interests for life or pv of annuity table best present value ordinary time value of money agec spring page 60 in booklet ppt. Whats people lookup in this blog. An annuity table represents a method for determining the present value of an annuity. The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate. Pv annuity table spectacular present value of annuity table f84 about remodel stunning home decor ideas with pv annuity table accounting principles fourth canadian editon problem solving techniques. Present Value Of An Ordinary Annuity Table New Present Value. As a current student on this bumpy collegiate pathway, I stumbled upon Course Hero, where I can find study resources for nearly all my courses, get online help from tutors 247, and even share my old projects, papers, and lecture notes with other students. Time Value of Money Page 3 TABLE 4 Present Value Of Annuity Factors (Ordinary Annuity) Periods 15 16 17 18 19 1. 8403 FV Value in the future of a single sum (1) A series of equal payments (or rents) received or paid at the beginning of a period, assuming a constant rate of interest. VAD (future value of an annuity due) VAD (present value of an annuity due. Conversion of ordinary annuity factor to annuity due factor for FW1P or PW1P: To determine the Future Worth of 1 Per Period ( FW1 P ) or Present Worth of 1 Per Period ( PW1 P ) factor for an annuity due, refer to the corresponding factor in AH 505 for an ordinary annuity and multiply it by a factor of (1 the periodic interest rate). The graphic shows that the annuity has a present value of 20, 849. Of course, there is a PRESENT VALUE OF AN ANNUITY DUE TABLE (see the appendix) to ease the burden of this calculation (5, 000 x 4. Calculate the present value interest factor of an annuity (PVIFA) and create a table of PVIFA values. Create a printable compound interest table for the present value of an ordinary annuity or present value of an annuity due for payments of 1. Since the annuity due is discounted for one less time period than the ordinary annuity, the present value of an annuity due is less than that of a comparable ordinary annuity. How to Calculate the Present Value of an Annuity Due. Future Value of an Ordinary Annuity. Of course, there is a PRESENT VALUE OF AN ANNUITY DUE TABLE (see the link at the companion website) to ease the burden of this calculation (5, 000 X 4. Please highlight the word and press Shift Enter. Present value of an ordinary annuity of 1 n 20 i 6 Table 4 Present value of 1 n from ACG 3141 at Florida Atlantic University An annuity table represents a method for determining the present value of an annuity. The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate. You can view a present value of an ordinary annuity table and factors by clicking PVOA Table. The first column (n) refers to the number of recurring identical payments (or periods) in an annuity. The other columns contain the factors for the interest rate (i) specified in the column heading. Table 5Future Value of an Annuity Due of 1. TABLE 5 Future Value of an Annuity Due of 1. It is used to calculate the future value of any series of. where r R100, n mt where n is the total number of compounding intervals, t is the time or number of periods, and m is the compounding frequency per period t, i rm where i is the rate per compounding interval n and r is the rate per time unit t. Annuity chart ozil almanoof co present value of annuity table ozil almanoof co present value of ordinary annuity table pdf awesome home present value of ordinary annuity ozil almanoof co. Whats people lookup in this blog: Present Value Of Ordinary Annuity Table Pdf; Uncategorized. Present value of an ordinary annuity table Determining the Size of Annuity: There are problems in which we may be given the present value of an annuity and need. How to use a Present Value Of An Ordinary Annuity Table (PVAF Table) Present Value of an Ordinary Annuity Calculator. An annuity is a series of equal payments or receipts that occur at evenly spaced intervals. Leases and rental payments are examples. The payments or receipts occur at the end of each period for an ordinary annuity while they occur at the beginning of each period. Present Value of an Ordinary Annuity The present value of an annuity is the current worth of a series of regular and equal cash flows to be received at a specific date in the future based on a specific interest rate. The difference between the present value of an ordinary annuity with payments of 100 per year at 10 compounded annually for 10 years and an annuity due with payments of 100 per year at 10 compounded annually for 10 years is. Calculating The Rate I In An Ordinary Annuity Accountingcoach Extraordinary present value of annuity table design gallery best present value annuity tables double. Present Value of Annuity is a series of constant cash Flows (CCF) over limited period of time say monthly rent, installment payments, lease rental. There are two types of Annuity: Ordinary Annuity or Deferred Annuity. If constant cash flow occur at the end of each periodyear. Annuity chart maggi locustdesign co annuity chart maggi locustdesign co future value of ordinary annuity table com solved present value of an ordinary annuity i 11 n 9per Whats people lookup in this blog. The present value of an ordinary annuity is less than that of an annuity due because the further back we discount a future payment, the lower its present value each payment or cash flow in an. The present value of an ordinary annuity table provides the necessary factor to determine that 5, 000 to be received at the end of each year for a 5year period is worth only 18, 954, assuming a 10 interest rate (5, 000 X 3. Remember, an Annuity Due is an annuity with payments beginning at the beginning of the period. Therefore, with an Ordinary Annuity, payments begin at the end of the period. The present value of an annuity is the current value of future payments from an annuity, given a specified rate of return or discount rate. The annuity 's future cash flows are discounted at the. 3 Present Value of an Annuity; Amortization Present Value (PV) of an ordinary annuity: 1 (1 )i n PV PMT i i: Rate per period n: Number of periods Notes: Payments are made at the end of each period. 17 Construct an amortization table for the first 3 months. Suppose your parents decide to give you 10, 000 to be put in a. Study Notes Quantitative Session For Examina Future Value Ordinary Source Present value of ordinary annuity table com solved present value of an ordinary annuity i 11 n 9per present value of ordinary annuity kleo beachfix co future value of ordinary annuity table com This type of annuity is called an ordinary annuity, which means that when payments are made, they are applied at the end of each period. Taking an example from Wikipedia, what is the present value of a 5 year ordinary annuity with an annual interest rate of 12 with monthly payments of 100. Present Value Annuity Calculator. This calculator will calculate the present value of an annuity starting either with a future lump sum (loan) or with a future payment amount (retirement annuity), and for either an ordinary annuity or for an annuity due. Present Value of an Ordinary Annuity Problem 1. Find the present value of the ordinary annuity, with payments of 50 made quarterly for 10 years at 8 interest compounded quarterly. About Present Value of Annuity Calculator. The online Present Value of Annuity Calculator is used to calculate the present value of an ordinary annuity which is the current value of a stream of equal payments made at regular intervals over a specified period of time. Annuity Mortality Tables Texas Department of. individual annuity mortality table adopted by the National Association of Insurance Commissioners (NAIC) after 1980. The PVIFA (Present Value Interest Factor Annuity) table is only slightly more complicated, but start by creating another copy of the PVIF table. The complication is because we want the table to handle both regular annuities and annuities due. This table shows the present value of an ordinary annuity of 1 at various interest rates (i) and time periods (n). It is used to calculate the present value of any series of equal payments Three approaches exist to calculate the present or future value of an annuity amount, known as a time value of money calculation. You can use a formula and either a regular or financial calculator to figure out the present value of an ordinary annuity. This present value of annuity calculator estimates the value in todays money of a series of future payments of the same amount for a number of periods the interest is. Finding the present value of an ordinary annuity using Excel's PV function. The following solved problems illustrate the distinction between an ordinary annuity and an annuity due. At 5 annual interest, what is the difference in the present value of 100 paid at the end of each year for 10 years and 100 paid at the beginning of each year. Present Value Of An Annuity Based on your inputs, this is the present value of the annuity you entered information for. The present value of any future value lump sum and future cash flows (payments). The equation for calculating the present value of an ordinary annuity is: Assuming the interest rate is 12 per year (or 1 per month), 8, 497. 20 is the present value amount that you could borrow today if you were to make 24 monthly payments of 400 each starting at the end of the first month. By looking at a present value annuity factor table, the annuity factor for 5 years and 5 rate is 4. This is the present value per dollar received per year for 5 years at 5. Therefore, 500 can then be multiplied by 4. 3295 to get a present value of 2164. The present value of annuity formula determines the value of a series of future periodic payments at a given time. The present value of annuity formula relies on the concept of time value of money, in that one dollar present day is worth more than that same dollar at a future date. Present Value and Future Value Tables Table A1 Future Value Interest Factors for One Dollar Compounded at k Percent for n Periods: Table A2 Future Value Interest Factors for a OneDollar Annuity Compouned at k Percent for n Periods: FVIFA k, n Present Value and Future Value Tables. Accounting And The Time Value Of Money Wiley Table 64: Present Value of an Ordinary Annuity of 1. Table 65: Present Value of an Annuity Due of 1. Steps in Solving Compound Interest Problems. The Future Value of an Annuity Due is identical to an ordinary annuity except that each payment occurs at the beginning of a period rather than at the end. Since each payment occurs one period earlier, we can calculate the present value of an ordinary annuity and then multiply the result by (1 i). table 64 present value of an ordinary annuity of 1 The present value of the resale value is 75, 000 0. table 62 present value of 1 Therefore, the total present value for the company is 296, 637 17, 954 314, 591..

-

Related Images: